Budget

The budgeting power of the State Parliament – a prerogative

The State Parliament must approve the state budget. As most political projects cost money, every draft budget is a type of government agenda in figures. The State Parliament is exclusively responsible for passing a budget and thus granting the government the financial means to shape policy. For this reason the State Parliament’s budgeting power is often referred to as a parliamentary prerogative. This is reflected in two components of budget legislation: the drafting of the Budget Act as well as the corresponding budget itself. The budget serves to establish and cover the financial requirements of the state’s foreseeable expenditure in each financial year. The budget includes all of the expected revenue, foreseeable expenses as well as any required commitment authorisation for a given financial year. Article 65 Para. 1 of the Constitution of Lower Saxony states: ‘The budget must balance revenue and expenditure.’ The budget is passed with the Budget Act.

The process involved in compiling a budget is very extensive and begins as early as the start of the preceding year. First of all, various bodies, such as ministries or even the State Parliament, submit their requirements to the Ministry of Finance for Lower Saxony. The ministry reviews the projected means and compiles a draft budget accordingly. It can amend the estimates in agreement with the bodies involved. The resulting draft Budget Act and the corresponding budget itself is determined by the state government and tabled in the State Parliament.

The development of the Budget Act

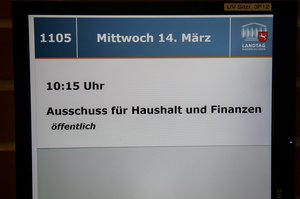

The deliberation process for the Budget Act follows the normal legislative process: after initial deliberation in the plenary session, the draft Budget Act is passed onto the Committee for Budget and Finances. In this committee, the fiscal policy makers of the parliamentary groups draft a recommended resolution for Parliament as a whole. In accordance with parliamentary tradition, a representative of the largest opposition party chairs the budget committee.

The recommended resolution of the expert committee forms the basis of the second and usually final deliberation in the plenary session. Parliament is not bound by the government’s bill, but it must ensure the necessary financial cover for any changes. The Budget Act and the corresponding budget are passed by a final vote in the plenary session.

Special measures and constant oversight

In the event that a Budget Act is not passed in time, the state will not be left without funds. In such cases, the provisional fiscal management provided for in the constitution takes effect (Article 66 Para. 1 of the Constitution of Lower Saxony). This special type of fiscal management allows the highest state authorities and some other bodies to fulfil their ongoing commitments in the absence of a Budget Act. If additional funds are required unexpectedly – for example because of a crisis situation – an additional budget can be passed.

Implementation of the budget is strictly controlled by Parliament. One instrument in this respect is the discharge procedure, which is carried out by the State Parliament for every budget. This is based on the reports of the State Audit Office. In addition, the State Parliament has various rights to information and participation when implementing the budget.

Further information

The breakdown of revenue and expenditure for each financial year can be found on the website of the Ministry of Finance for Lower Saxony. The budget figures are displayed there in both tables and graphs.